![]() Elder Fraud – Article

Elder Fraud – Article

Understanding the Risks and Protecting Seniors

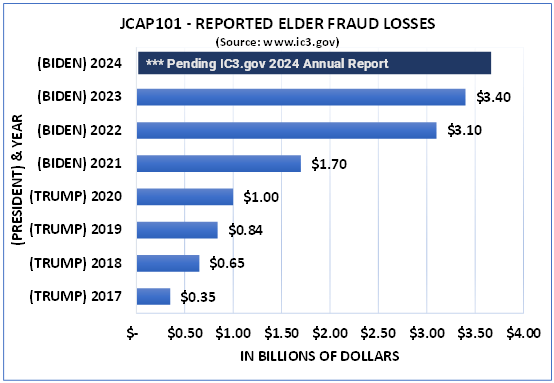

Elder Fraud is a growing concern that affects millions of seniors each year. As the population ages, scammers are increasingly targeting older adults, exploiting their vulnerabilities and often leaving them in financially precarious situations. In this article, we will explore the various forms of elder fraud, the warning signs, and effective strategies for prevention.

What is Elder Fraud?

Elder Fraud encompasses a range of deceptive practices aimed at exploiting older adults for financial gain. This type of fraud can take many forms, including:

- Investment Scams: Fraudsters promise high returns on investments that do not exist.

- Telemarketing Scams: Scammers call seniors, claiming they’ve won a prize and need to pay a fee to claim it.

- Romance Scams: Scammers build relationships online to exploit emotional vulnerabilities and solicit money.

- Identity Theft: Personal information is stolen to access seniors’ financial accounts or open new credit lines in their names.

- Home Repair Scams: Fraudsters offer home repair services but either do subpar work or take the money without completing the job.

Warning Signs of Elder Fraud

Recognizing the signs of elder fraud is crucial for early intervention. Family members and caregivers should be vigilant for the following red flags:

- Sudden Changes in Financial Habits: Unexplained withdrawals or changes in spending patterns.

- Social Isolation: Seniors becoming withdrawn or isolated from friends and family, which may make them more vulnerable to scams.

- Confusion or Memory Loss: Seniors may become confused about their financial situation or forget their recent transactions.

- Unusual Communication: Receiving unexpected calls or messages from individuals claiming to be from legitimate organizations.

Preventing Elder Fraud

Preventing elder fraud requires a proactive approach. Here are effective strategies to protect seniors:

- Educate Seniors: Teach older adults about common scams and how to recognize fraudulent behavior. Awareness is the first line of defense.

- Encourage Open Communication: Foster an environment where seniors feel comfortable discussing their financial concerns with family members or trusted friends.

- Monitor Financial Activity: Regularly review bank and credit card statements for suspicious transactions. Setting up alerts for unusual activity can also help.

- Use Technology Wisely: Encourage seniors to use security features such as two-factor authentication and strong passwords for online accounts.

- Report Suspicious Activity: If fraud is suspected, report it immediately to the local authorities and financial institutions. Reporting can help prevent others from becoming victims.

Conclusion

Elder Fraud is a serious issue that can have devastating consequences for older adults and their families. By understanding the risks, recognizing the warning signs, and implementing effective prevention strategies, we can help protect seniors from falling victim to fraud. It is essential for families, caregivers, and communities to work together to safeguard the financial well-being of our elderly population.

By raising awareness and promoting education, we can create a safer environment for seniors and ensure they enjoy their golden years free from the threat of fraud.

Agency Resourses:

- (FBI) (www.fbi.gov) – “Elder Fraud in Focus“

- (FBI) (www.fbi.gov) – “Elder Fraud – Each year, millions of elderly Americans fall victim to some type of financial fraud or confidence scheme, including romance, lottery, and sweepstakes scams—just to name a few.“

- (USDOJ) (www.justice.gov) – “Elder Justice Initiative (EJI)“

- (IC3) (www.ic3.gov) – “Elder Fraud – We’re Here For You“

- (DOJ-OVC) (ovc.ojp.gov) – “National Elder Fraud Hotline“

- (USDOJ) (www.justice.gov) – “Elder Justice Initiative – Financial Exploitation“

- (CFPB) (www.consumerfinance.gov) – “Protecting older adults from fraud and financial exploitation“

- (DOJ-OVC) (ovc.ojp.gov) – “Helping Crime Survivors Find Their Justice – 2023 Report to the Nation“

- (FTC) (consumer.ftc.gov) – “Fighting fraud against older adults“

- (FTC) (consumer.ftc.gov) – “Scams Against Older Adults“

- (SEC) (investor.gov) – “Resources for Older Investors“

- (SEC) (www.sec.gov) – “A Guide for Seniors – Protect yourself against investment fraud” (PDF)